Author: Bob Press (TAP Financial Partners)

The pressures of delivering products or services, supply chain issues, and customer payment times (the proverbial cash conversion cycle), strain the cash flow of most small businesses at some point. New customers or orders, the engine that makes growth possible, can put further and unexpected strains on the amount of cash on hand. While principals traditionally focus on getting products or services delivered, doing so often requires them to cut back on or delay payment of expenses wherever they can.

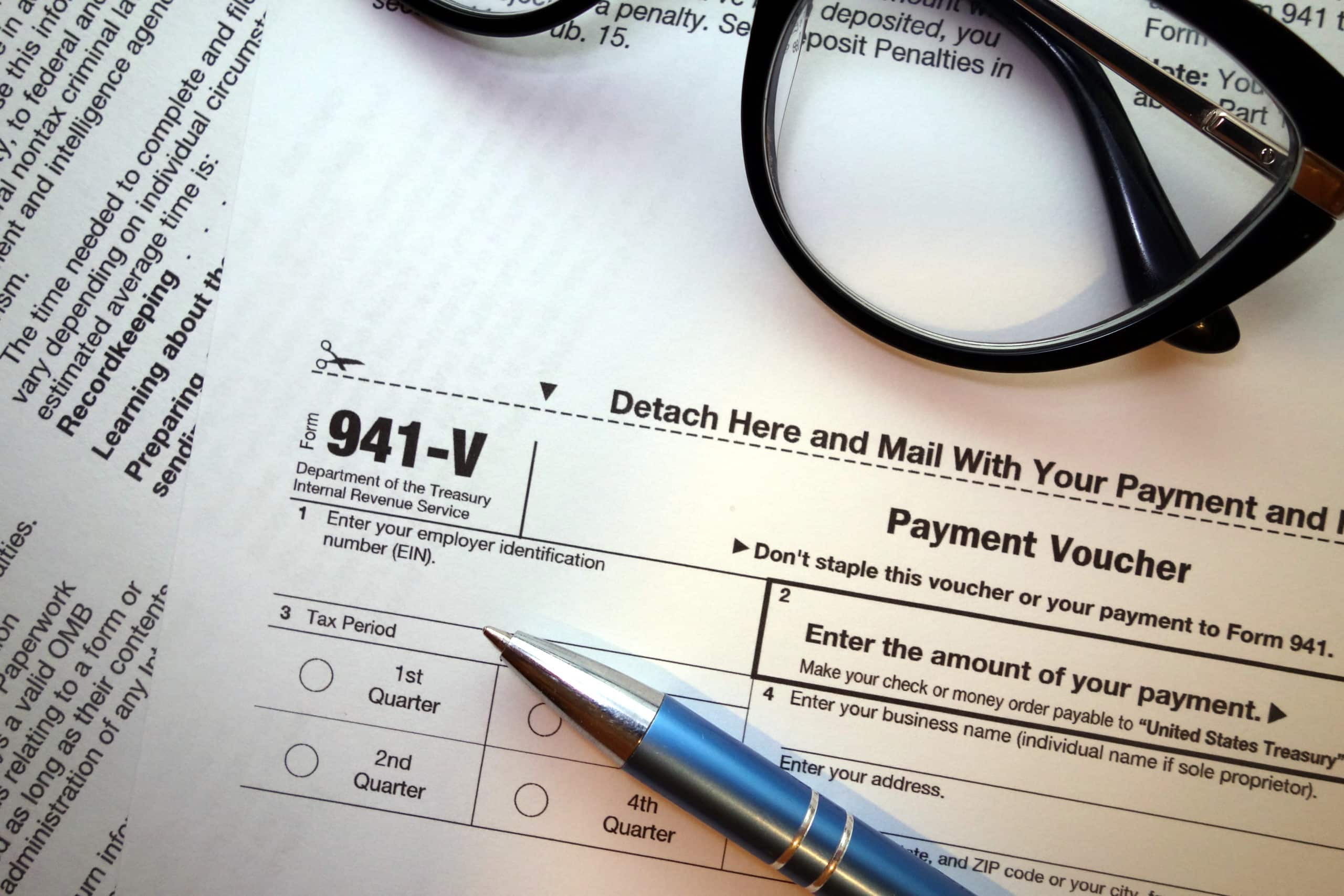

Unlike larger businesses and those that use payroll processing services, small company C-suite executives can be tempted to delay the payment of “941” or payroll taxes. These taxes include employee payroll taxes, the employer contribution of taxes, and employer- paid Medicare tax in the U.S. Since the payment of this is under the principal’s control, it can be an easy place to hold or delay payments.

While this may seem like a simple panacea, nonpayment, or delay of payment of so called “941 taxes” is a very slippery slope. While the Internal Revenue Service (IRS) likely won’t immediately knock on your door, one revenue agent once told us that they view those who withhold employee and company payroll taxes as stealing their own workforce and the government.

When the IRS does come knocking, it’s with a thud. The government is not a regular creditor, but a “super-creditor” with the abilitiy to seize assets, freeze bank accounts, and levy liens with impunity. Their timetable is their own and they never forget about funds. While they are often willing to make deals for payments, those usually involve some or all of the ‘trust fund’ penalties that accrue with non or late payments.

So, despite the near-term attractiveness, we strongly urge business owners to avoid this poisoned chalice. If this is an issue you or someone you know is currently facing, there are other ways to make up for the shortfall and avoid getting in waters to deep to navigate. You can learn more by contacting us at info@tap-advisory.com to be informated about what options exist that provide solutions to this difficult situation.

0 Comments