It’s been more than two years since COVID-19 changed the way societies around the world function. Many countries have returned to as close as they can get to business as usual, relying on widespread vaccination and the lower hospitalization rates of the Omicron variant.

However, China continues to employ practices from the early stages of COVID. Adopting a “zero-tolerance” policy toward COVID, the government institutes city-wide lockdowns whenever the virus appears.

This policy is causing slow-downs and shutdowns in China’s factories. Due to the global nature of manufacturing and supply chains, these disturbances have far-reaching consequences, especially for small businesses.

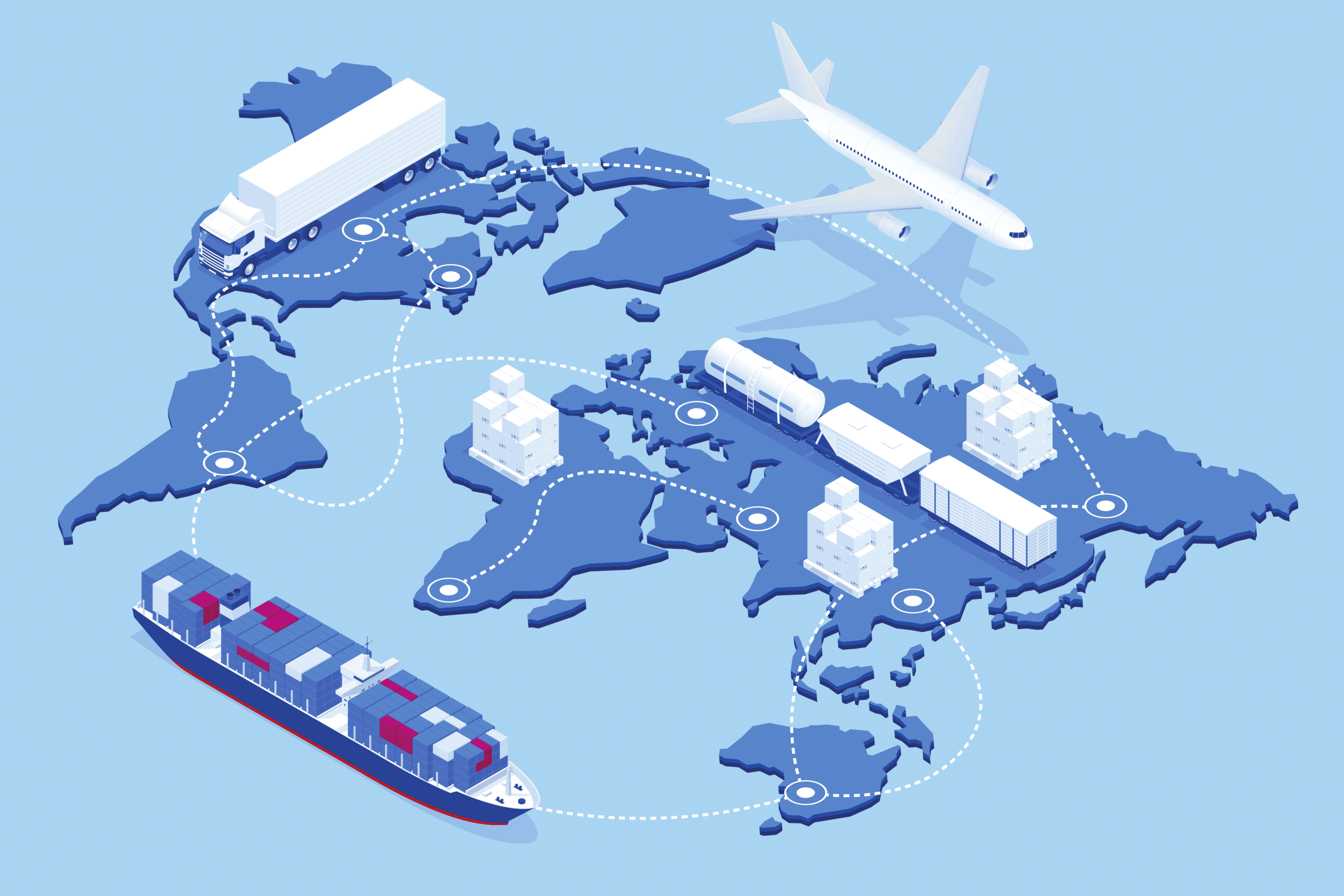

Because it’s now so easy to source from other countries, supply chains have never been more globalized, with many goods traveling across half of the world to their destination.

Some countries have emerged as key players in manufacturing. In 2009, the United Nations Statistics Division put China as responsible for 28.7% of global manufacturing output, the highest by far of any country (the United States, by comparison, accounted for 16.8% of production).

The pandemic rocked the manufacturing world, creating breakdowns and delays everywhere. The virus led to an increase in absenteeism at work and a slowdown in production because of precautions to protect employees. This has created a ripple effect leading to shortages and delays in production worldwide.

As such a cornerstone in manufacturing, the shutdowns in China have been especially devastating. And now, in the third year of the pandemic, the “zero-COVID” policy and the emergence of the hyper-contagious Omicron variant are continuing to slow recovery.

While the effect on consumers and corporations has been widely publicized, supply chain disruption has hit small businesses especially hard, since many don’t have the reserves needed to weather unexpected and/or devastating changes.

According to the U.S. Chamber of Commerce, 63% of small businesses have increased their prices because of inflation and rising costs due to product shortages. And despite these raised prices, 45% have had to take out a loan.

COVID revealed the precariousness of extended supply chains, where any holdup along the way can have disastrous consequences. More than half of small businesses have experienced direct supply disruption, leading to 63% changing their supply chains in the last 6 months.

The globalization of supply chains has proven detrimental in this crisis. Therefore, small businesses have to react fast, be flexible, and look for alternative sources closer to home.

TAP Financial Partners can help your small business adapt and thrive. Contact us today to see how we can help you!

0 Comments